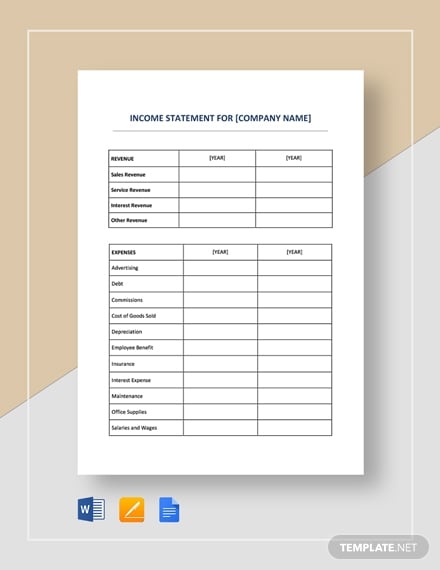

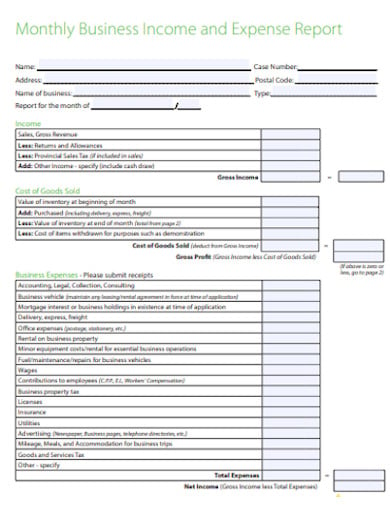

Each time employees on business duty pay in cash, they use an expense report to itemize their expenditures.Here's how expense reporting works in more detail: Money spent on lodgings during business travels.Money spent on business lunches and dinners with clients, or.Money spent on means of transportation during business travels,.Money spent on gas during business travels or for running everyday business errands,.Notable examples of items that should be included in an expense report include: However, expense reports can also be used to: This record usually serves as a basis for a cash reimbursement request for the amounts employees spend while on a particular business duty. Happy budgeting.An expense report is a form that lets you track all business-related costs - from employee-incurred expenses to project-specific costs. And the right Google Sheets budget template can make that process easier than ever. No matter what your financial goals are, a budget is a great starting point to reach them.

Because remember: Balance is the key to creating (and sticking to) a good budget. And to help you figure out where the fun stuff fits into your budget. It’s designed to make budgeting a little easier. Start with this Google Sheets Monthly Budget template (you’ll need to make a copy of this one, too). This one also offers a subscription for automatic updates. PS: Like the FIRE spreadsheet above, you’ll have to make a copy to customize it. This Quarterly Estimated Tax Sheet helps you estimate your business’ quarterly tax bill in real time. The good news is there’s a Google Sheets budget template to help you do that, too.

You’ll need to add important business stuff to your budget.

Psst…this spreadsheet doesn’t give you the option to edit, so you’ll need to make a copy of the original file to customize it. If that’s you, this Google Sheets budget template makes it easy to stay on top of your net worth and the return on your investments. And it’s picking up steam among those willing to invest up to 75% of what they earn. ICYMI: FIRE stands for financial independence, retire early. Use the FIRE spreadsheet to keep track of your progress.

0 kommentar(er)

0 kommentar(er)